What we call “Made in China” is indeed assembled in China, but what makes up the commercial value of the product comes from the numerous countries that preceded its assembly in China in the global value chain, from its design to the manufacture of the different components and the organization of the logistical support to the chain as a whole. ... If we continue, in this context, to base our economic policy decisions on incomplete statistics, our analyses could be flawed and lead us to the wrong solutions.

For instance, every time an iPod is imported to the United States, the totality of its declared customs value (150 dollars) is ascribed as if it were an import from China, contributing a bit more to the trade imbalance between the two countries. But if we look at the national origin of the added value incorporated in the final product, we note that a significant share corresponds to reimportation by the US, and the rest to the bilateral balance with Japan or Korea which should be allocated according to their contribution to that added value. In fact, according to American researchers, less than 10 of the 150 dollars actually come from China, and all the rest is just re exportation. In the circumstances, a re evaluation of the yuan — a topic which is very much in vogue these days — would only have a modest impact on the sales price of the final product and would probably not restore the competitiveness of competing products manufactured elsewhere.

Similarly, the statistical bias created by attributing the full commercial value to the last country of origin can pervert the political debate on the origin of the imbalances and lead to misguided, and hence counter-productive, decisions. Reverting to the symbolic case of the bilateral deficit between China and the United States, a series of estimates based on true domestic content cuts the deficit by half, if not more.He then goes on to make an important point about the US trade deficit with Asia rather than particular countries.

This impression is confirmed by other figures, if we accept to “debilateralize” them: if we look at the US trade deficit with Asia rather than its bilateral deficit with China, we note a remarkable stability over the past 25 years at something like 2 to 3 per cent of the United States’Increased trade with China has replaced trade with other parts of Asia, but this hasn't necessarily been as negative for the rest of Asia as this simple statement might imply. This is because the rest of Asia has also increased its exports with China, developing what is an increasingly important global production structure.

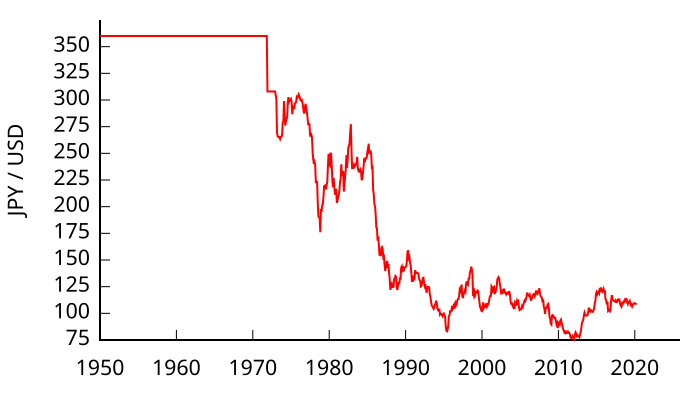

One of the remarkable facts that proponents of the argument that a higher Yuan will rebalance US-China trade need to think about is in relation to US trade with Japan. Though the Yen strengthened remarkably against the Dollar, from 360 yen to the dollar in the 1970s to as low as 80 to the Dollar in the mid-1990s, the trade deficit with Japan just kept on increasing.

|

| JPY-USD Exchange Rate http://en.wikipedia.org/wiki/File:JPY-USD_1950-.svg |

For a discussion on currency issues see Yipang Huang "A Currency War the US Cannot Win". (See also Martin Wolf "Why America is Going to Win the Global Currency Battle".)

Huang makes the point that:

Experts who are interested in Plaza II should first study carefully the experiences of the original Plaza Accord. The yen/dollar rate dropped from 250 in early 1985 to 150 in early 1988 and further to about 80 in mid-1995. But Japan’s current-account surpluses did not disappear.

Likewise, the real effective exchange rate of the US dollar fluctuated during the past three decades, but the US current-account deficits continued to climb, especially during the ten years preceding the global crisis. If the Plaza Accord did not achieve its original goal, why all of a sudden people became interested in this old idea again?

Now Lamy's brief is to encourage world trade liberalisation and so he has an agenda here, but it's worth thinking about his analysis, especially in relation to employment.

As for the impact on employment — understandably a rather sensitive issue in these times of economic crisis — once again the result can be surprising. Reverting to the case of the iPod, another study by the same authors estimates that on a global scale, its manufacture accounted for 41,000 jobs in 2006 of which 14,000 were located in the United States, 6,000 of them professional posts. Since American workers are more qualified and better paid, they earned more than 750 million dollars, while only 320 million less than half — went to workers abroad.

In this example, case studies have shown that the innovating country earns most of the profits; but traditional statistics tend to focus on the last link of the chain, the one which ultimately earns the least. Don’t get me wrong, I am not saying that this is always the case and that relocations always create more jobs than they destroy. ...

I simply wanted to highlight the paradoxes and the misunderstandings that arise when new phenomena are measured using old methods. Statistical survey experts know very well that “if you ask the wrong person, you will get the wrong answer”. Similarly, if you analyse a phenomenon using the wrong “measurements”, you will reach the wrong conclusions.What Lamy proposes is a new research agenda to rethink the analysis of world trade.

*The political economy of East Asia course is part of the Bachelor of Asian Studies and Bachelor of International Relations at Griffith University.

No comments:

Post a Comment

Please be civil ...